Alma Cargo Forwarding & Clearing L.L.C - | E-Showroom

Alma Cargo Forwarding & Clearing L.L.C - | E-Showroom

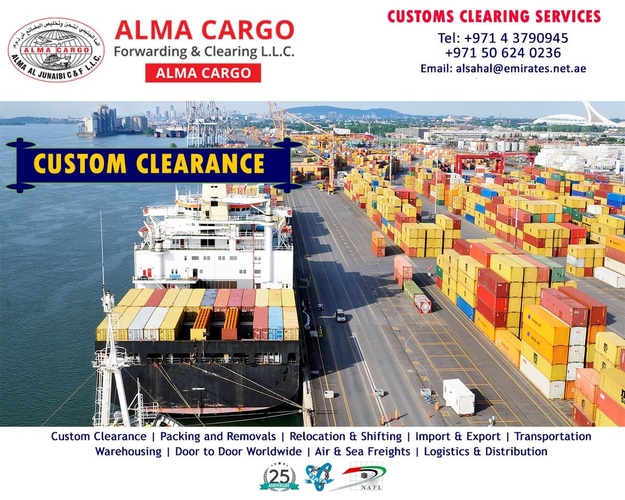

Alma Cargo Forwarding & Clearing L.L.C

20638 Warehouse No3 Lathifa Bin Hamdan Street , Oppo Al Khail Mall Dubai

United Arab Emirates

Gulf Yellow Pages Online is a Local Business to Business Directory in Gulf offering business list of more than 250,000 companies. You can find Hotels in Gulf , Companies in Gulf , Properties in Gulf , Travel info in Gulf through this Site. Yellow Pages Gulf Updated in 2025 Get Maximum Benefit for your Business Visit YP MarketPlaces

| About Us Careers Company Information User Guide About Us |

Buying Options Post Buying Leads Browse Categories Companies in Gulf How to Buy Buy From India |

Selling Options Post Selling Leads Browse Categories How to Sell Appoint Dealer |

Safety & Support Help Safety & Security Copyright Infringment |

Advertising How to Advertise? Host Website with us Elite Membership |

Method Of Payment Privacy Policy Refund Policy Dispute & Resolution Policy Terms |

| Thanks for Posting your Requirement

with

Gulf Yellow Pages Online

If you are not Verified Buyer then Please Verify Your Email to get Quotes from Verified Suppliers. |

|

Thanks for Reporting Error in Listing of on Gulf Yellow Pages Online

Our Technical Team will review the Information and will Rectify the Error as Soon as Possible. |

| Thanks for Reply.

Gulf Yellow Pages Online

Your Reply is Sent to the Buyer. |

| Thanks for Reply.

Your Reply is Sent to the Seller. |

| Ok Close |